What Great Paid Search Performance Hides, and Why D2C Marketing Leaders Need to Know

The “best-performing” paid search accounts don’t always fuel the most growth. As someone who’s audited and managed paid search accounts across…

The “best-performing” paid search accounts don’t always fuel the most growth.

As someone who’s audited and managed paid search accounts across dozens of D2C brands, I can tell you that great performance metrics don’t always mean great business outcomes. In fact, some of the cleanest, most efficient-looking performance I’ve seen came from accounts that were quietly stalling: narrowly optimized, under-invested and stuck chasing safe conversions.

If you’re a marketing leader responsible for both performance and growth, it’s worth asking: what is your paid search performance really telling you? And more importantly, what might it be hiding?

Strong ROAS Often Masks Brand Dependency

Branded search is nearly always the top performer in an account. But it’s also often the least incremental.

Many paid search reports blend branded and nonbrand together, or report topline ROAS without clarifying what’s actually driving it. That can hide just how reliant performance is on people who were already going to convert. I’ve seen brands put 70%+ of their budget into branded terms and chase 95% impression share in the name of “protection,” without ever questioning whether those efforts are truly incremental. These brands weren’t necessarily stuck, but they were leaving serious growth on the table by optimizing for optics instead of outcomes.

How do you know if this is happening in your account? Look for signs like:

- Branded search taking up a disproportionate % of conversions

- Blended ROAS that looks great but weak performance when isolating nonbrand

- No true holdout or incrementality testing to validate branded impact

High Conversion Volume Doesn’t Mean You’re Winning New Customers

When performance looks strong, it’s easy to assume your funnel is working. But many accounts are heavily fueled by returning customers, email activation and retargeting.

If you’re not separating customer cohorts, you could be spending a ton to reacquire the same users while your new customer CAC silently rises. This kind of blind spot often slips past standard reporting, especially when teams aren’t leveraging tools like Northbeam or Triple Whale to segment performance by new vs returning customers.

To understand where your growth is really coming from, look into:

- New vs returning customer breakdowns from MTA tools

- Remarketing and customer list spend relative to overall budget

- Whether returning customers are inflating results that should reflect acquisition

You Might Be Optimizing For the Wrong Signals

Google is highly effective at delivering on your signals. The real question is whether you’re sending the right ones.

Accounts with smart bidding strategies like TROAS or TCPA can produce strong-looking performance, but if your conversion tracking is flawed (e.g., overcounting, double-firing, poor first-party signal hygiene), then optimization is happening on bad data.

I’ve seen accounts where in-platform ROAS or CPA looked solid, but source-of-truth tools like Northbeam painted a different picture. Without deeper analysis, it’s easy to overestimate the impact of performance and miss where scale actually needs to come from.

What to audit:

- Conversion actions in Google Ads: Are they deduped? Prioritized? Aligned with true business value?

- Assumed attribution impact: Are you drawing conclusions from platform data or P&L trends without validating with holdout testing or cohort analysis?

- Signal integrity: Are you feeding the algo high-quality, real-time data?

Good Performance Can Defer the Harder Questions

When the account looks strong, most brands don’t question it. And that’s exactly when deeper problems creep in:

- You delay creative iteration because “what’s working is working”

- You avoid testing new landing pages or offers

- You don’t invest in YouTube, Demand Gen, or upper funnel because they “pull down ROAS”

Over time, this creates an invisible ceiling. Everything is optimized but nothing is evolving.

Attribution Bias Reinforces the Wrong Tactics

Last-click. GA4. In-platform reporting. All of these disproportionately credit channels that show up last like branded search, email, direct-to-site.

That means channels like YouTube or Demand Gen rarely get the credit they deserve, and smart, long-term strategies often get cut in favor of “safer” channels that are already saturated.

The result?

- Paid search “looks great” but drives fewer net new customers

- You pull budget from upper funnel, which shrinks your audience pool

- You lose sight of what’s actually driving demand

What great performance hides is the erosion of scale.

So What Should You Do About It?

Here’s how to build a performance strategy that’s both honest and scalable:

- Isolate branded vs non-brand performance regularly

- Run holdout tests to validate true channel incrementality

- Use new customer metrics as a north star

- Audit conversion actions and prioritize real value

- Invest in creative, audience and CRO even when things “look good”

- Fund upper funnel initiatives alongside your core performance mix

Final Thoughts

Strong platform performance can be comforting. It can also be deceiving.

Don’t let great-looking metrics mask the hard truths that actually matter to your business. Interrogate your performance. Invest in what’s hard to measure. Build for scale and not just for the spreadsheet.

Related Articles

- General

Speedboat Advertising Is Dead. Long Live Cruise Ships

Introduction to the concept It is so easy to launch ads on Meta and Google. You can do it in a…

- Paid Social

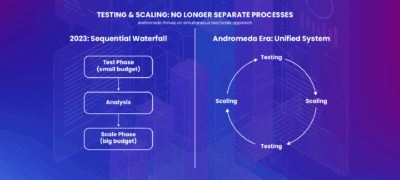

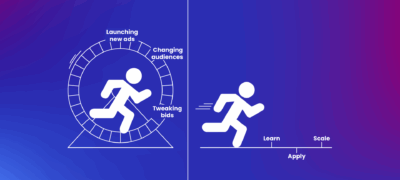

Meta Andromeda: The AI Revolution That is Redefining Digital Advertising

Meta Andromeda is trending everywhere this month, but the algorithm change has quietly reshaped ad performance since December 2024. The real…

- General

5 Reasons DTC Brands Plateau

They never run the numbers Every brand knows their ROAS, CPC, CTR, etc. How many brands can tell you their contribution…

How can we help you grow?